Indicators for Health Insurers

KPIs (Key Performance Indicators) for health insurers can vary depending on the specific objectives and priorities of each company. However, some of the main KPIs that are usually tracked by health insurers include:

Customer Satisfaction Index: Measures customers’ overall satisfaction with the insurer’s services, which may include the quality of customer service, ease of access to medical care, and clarity of information provided.

Customer retention rate: Indicates the number of customers who renew their policies with the insurer compared to those who choose to cancel them. A high retention rate is often an indicator of customer satisfaction and loyalty.

Rate of claims resolved satisfactorily: Measures the percentage of insurance claims that are resolved satisfactorily for the client and within the established deadlines. This may include how quickly claims are processed and paid.

Medical cost ratio: It is the percentage of the insurer’s total income that goes to pay medical claims and expenses related to medical care. A high ratio may indicate high medical costs and potential profitability problems.

Health index of the insured population: Measures the general health of the insured population using indicators such as chronic disease rates, hospitalization rates and other health factors. A healthier population may mean lower longterm medical costs.

Administrative expense ratio: Represents the insurer’s administrative costs in relation to its total income. A high ratio may indicate operational inefficiencies.

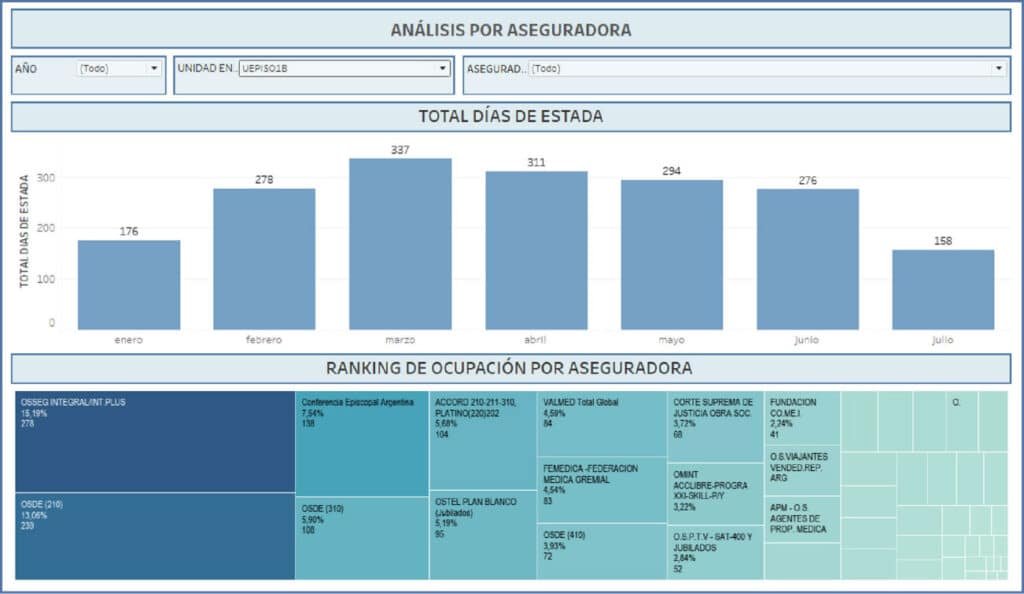

Health services utilization rate: Measures the frequency with which policyholders use the medical services covered by their policy. It may include doctor visits, hospitalizations, surgical procedures, among others.

Solvency and liquidity index: Evaluates the insurer’s ability to cover its short-and long-term financial obligations. A high ratio indicates a solid financial position.

These are just a few examples of common KPIs used by health insurers. It is important that each insurer defines its own KPIs based on its strategic objectives and the environment in which it operates.